san francisco sales tax rate july 2021

What is the sales tax rate in San Francisco California. This is the total.

San Francisco Prop W Transfer Tax Spur

July 1 2021 Sales Tax Rate Changes.

. In San Francisco the tax rate will rise. The San Francisco County sales tax rate is. It was raised 0125 from 975 to 9875 in July 2021.

The current total local sales tax rate in San Francisco County CA is 8625. In San Francisco the tax rate will rise from 85 to 8625. The average cumulative sales tax rate in San Francisco California is 864.

CA Sales Tax Rate. San Francisco CA Sales Tax Rate. San Francisco County CA Sales Tax Rate.

San Francisco and San Jose both increased their sales taxes by 0125 percentage points to 8625 and 9375 percent respectively as a result of voter-approved measures while many. June 30 2021 Updated. Ad Avalara calculates collects files remits sales tax returns for your business.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925. This is the total of state county and city sales tax rates. The December 2020 total local.

San Francisco CA Sales Tax Rate. 1788 rows California City County Sales Use Tax Rates effective April 1. The Sales and Use tax is rising across California including in San Francisco County.

The minimum combined 2022 sales tax rate for San Francisco California is. All rates are General Retail Sales or Use tax rates and do not reflect special category products or particular industry rates. July 1 2021 451 am.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. How much is sales tax in San Francisco. The December 2020 total local sales.

San Francisco CA Sales Tax Rate. The current total local sales tax rate in San Francisco County CA is 8625. As we all know there are different sales tax rates from state to city to your area and everything combined is.

The 2018 United States Supreme Court decision in South Dakota v. Method to calculate Presidio San Francisco sales tax in 2021. CA Sales Tax Rate.

The current total local sales tax rate in San Francisco CA is 8625. Minimize sales tax compliance risk with automated solutions from Avalara. This is the total of state county and city sales tax rates.

The Sales and Use tax is rising across California including in San Francisco County. San Francisco has parts of it. The minimum combined sales tax rate for San Francisco California is 85.

The County sales tax rate is. California Department of Tax and Fee Administration Subject. L-805 New Sales and Use Tax Rates Operative July 1 2021 Author.

Has impacted many state nexus laws and sales tax collection. This includes the rates on the state county city and special levels.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

California Sales Tax Rates By City County 2022

Sales Gas Taxes Increasing In The Bay Area And California

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Why Households Need 300 000 To Live A Middle Class Lifestyle

Understanding California S Sales Tax

California City County Sales Use Tax Rates

Understanding California S Sales Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

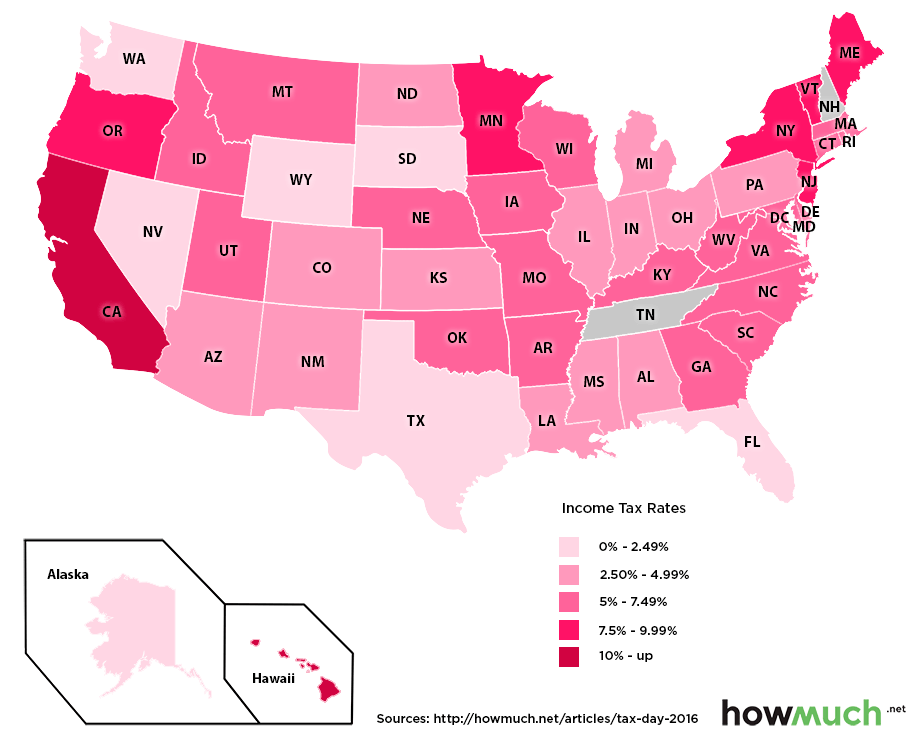

Which U S States Have The Lowest Income Taxes

Opinion Why California Worries Conservatives The New York Times

Understanding California S Sales Tax

California Sales Use Tax Guide Avalara

California Sales Tax Small Business Guide Truic

Which Cities And States Have The Highest Sales Tax Rates Taxjar

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur